As the recession ended, the interest rates have remained close to zero. This is an encouraging percentage because business and household investment is promoted. When businesses and people have the incentive to invest, they help the economy. Products that need demand to survive are being purchased and the economy is receiving the benefits of producers and consumers interacting.

The conundrum of investment and consumption appears when inflation increases. The real cost of products are increased and are less likely to be invested in. A wage-price spiral occurs when the consumers who were able to purchase goods at the low price demand a higher wage to keep up with inflation. Businesses have to raise prices to offset the added expenses of paying workers more. This causes margins to decrease and innovation to come to a halt.

Policymakers may decide to increase inflation to get out of the current situations, but it has been proven in other countries that it does not work. Inflation–when encouraged–can run-up rather quickly.

When policymakers are confronted with the issue of an increase in inflation, they greet it with an air of normalcy. They claim that inflation should be measured by core inflation and that inflation is not measured correctly. The true measure of inflation is not accurate because it includes the volatile prices of food and energy. Once commodity prices increase the public believes that inflation will be soon to follow. The problem is that the people that are hurt the most by inflation are the people who consume groceries and other products that are not measured by core inflation. Inflation must account for the food and energy prices to receive a fair assessment on the future of inflation.

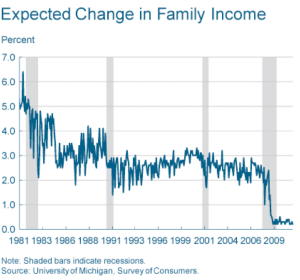

Households are pessimistic as ever and do not seem to be persuaded that their income will increase over time. If inflation does increase as expected, the people in the middle-class will be hit the hardest. Here is a graph that indicates that households are worried that their incomes will not increase and stagnate at zero percent. The future could be in jeopardy for households if their predictions match the actuality.

In order for the economy to be boosted, innovation must be created and risk taking must be valued. If prices increase, the value created will need to provide a level of quality that has never been achieved before. In order for this country to prosper, goods cannot be made with less effort and determination.